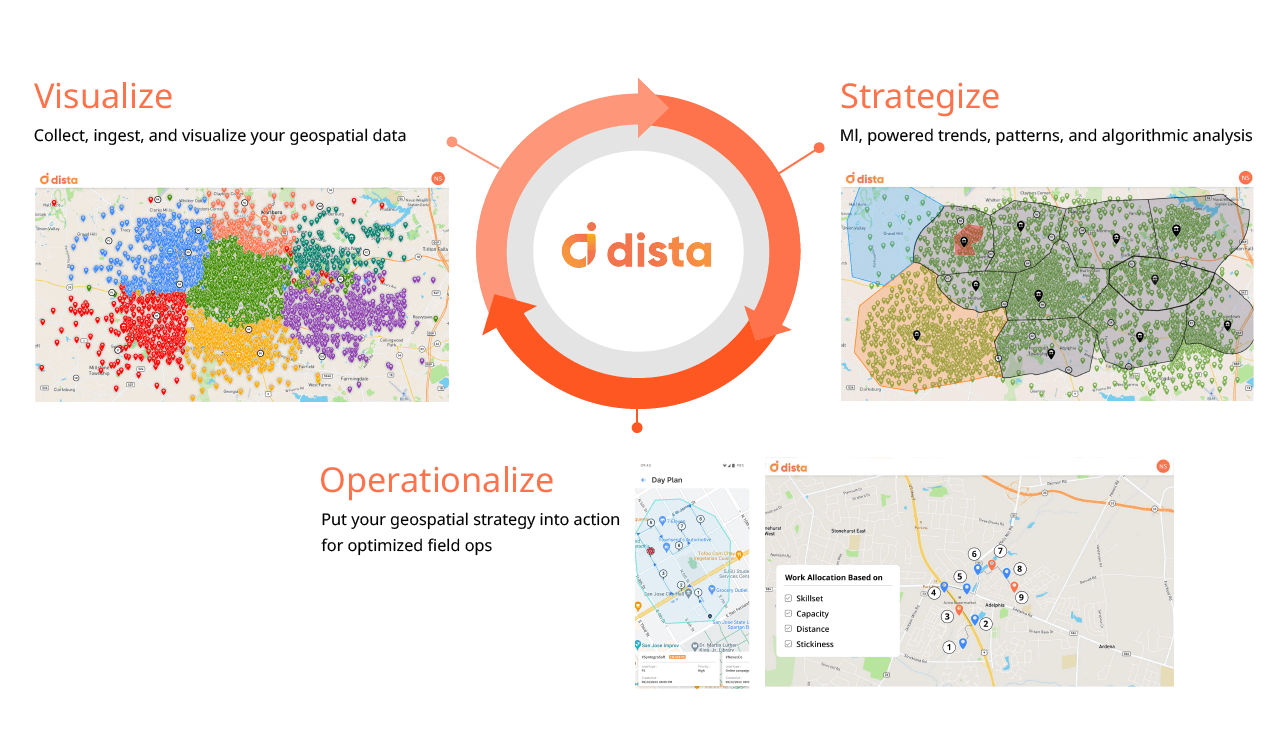

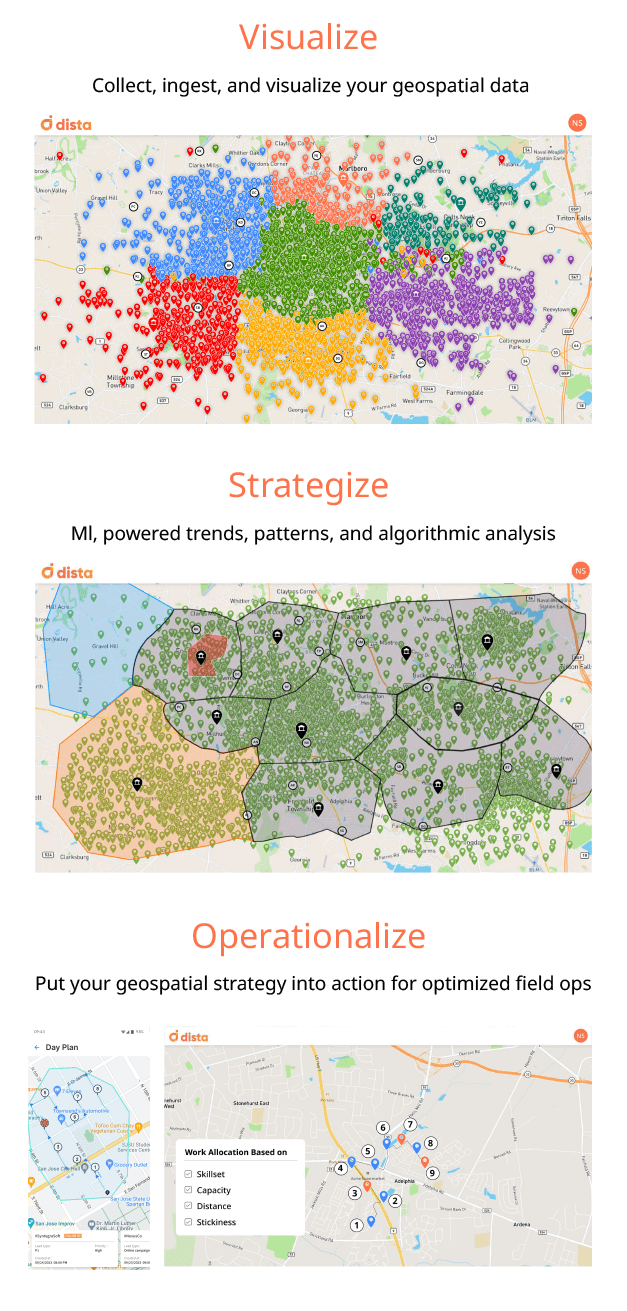

Visualize. Strategize. Operationalize.

Dista’s Framework to Applying Location Intelligence

Our Products

Custom SaaS products built on low-code/no-code location intelligence platform.

Dista Sales

Dista Service

Dista Deliver

Dista Insight

Our Solutions

An AI-powered suite of functional and industry solutions to get the most out of your geo-data.

Applying Location Intelligence Across Industries

Banking & Finance

Leverage AI-powered tools to amplify customer acquisition, streamline doorstep banking, automate debt collection, and more. Accelerate sales pipeline, and improve customer experience with a location intelligence powered product suite.

Insurance

Amplify insurance agent productivity by creating smart beat plans. Mitigate risks, strengthen fraud detection, and simplify agency management. Explore how Dista helps drive seamless Bancassurance operations and streamlines the claims process.

Logistics & Shipping

Dista’s delivery and dispatch management solution will turbocharge your first, mid, and last mile deliveries. Explore how organizations can transform their logistics lifecycle and strengthen supply chain network design with our platform.

Retail & CPG

Get real-time location insights to scale operations, accelerate omnichannel fulfillment, and empower sales and distribution teams with smart beat plans. Learn how retail and CPG organizations can improve sales coverage and delivery efficiency.

Pharma

Improve Medical Rep (MR) productivity and monitor their field ops in real time. If you are a pharma or a life science organization, Dista will help strengthen your distributor network and ensure faster order fulfillment.

Food & Beverage

Supercharge hyperlocal deliveries, streamline order management, and optimize resource allocation with Dista. Empower your outlets with actionable location insights to boost orders and expand to new locations with faster store setup.

See How Enterprises Leverage Location Intelligence with Dista

“With Dista Deliver, we’ve been able to keep our 30 minute SLA. The platform orchestrates over 1500 riders and tracks orders from over 500 outlets across India. It helped us define serviceable areas, expand customer coverage, facilitate new store onboarding.”

Prashant Gaur

Chief Brand and Customer Officer

Pizza Hut, India Subcontinent

“With Dista’s AI-enabled location intelligence platform, CMS provided seamless, faster, safer, and hassle-free doorstep cash transportation service. There was an increase in agent productivity while a reduction in cash movement overheads with the right-sizing of custodians and vans.”

Rohit Kilam

CTO

CMS Info Systems

“Dista Service helped us with field investigation of our prospects as well as loan servicing for customers. Over 10K users are using the app to get real-time updates on their loan status, raise queries, respond to queries and more.”

Sandeep Gambhir

Head – Digitalisation & Marketing

ICICI Home Finance

Pankhuri Goel

Director, Fulfilment & Experience

Meesho

“By leveraging Dista Deliver, we are delivering over 2000 orders per month across 700 stores. Their system helped our store managers get real-time visibility on delivery executives and enabled them to allocate orders automatically. “

Anirban Chakraborti

Head of Digital

Sangeetha Mobiles

“Dista’s employee transportation management software streamlined ride booking for our employees and optimized their pick-up and drop-offs. It offered complete transparency on distance traveled, thereby resulting in effective management and significant savings.”

Nilesh Nerlekar

HR Manager

Sigma Electric Manufacturing Corporation

“As a startup, we thought the technology required for our unique business model would be available only to industry giants after spending millions of dollars. However, Dista offered the best solution to streamline our entire delivery process.”

Ashutosh Mahindru

Founder & CEO

Foodtech Ventures

“With Dista, we have catered to over 20,000 book lovers in more than 300 housing societies. We expanded our sales coverage by leveraging their scheduling software for beat planning of our book trucks to visit more residential societies per day.”

Ashay Walambe

Co-founder

PustakWale

Anirban Chakraborti

E-business and Omnichannel Platforms Head

Wellness Forever

Vikas Gupta

Co-founder

MyDiagnostics

“Dista’s delivery management product, Dista Deliver, helped streamline our delivery business for ~750 KFC stores across India. Dista Deliver enables us to schedule, allocate, and track more than 10,000 self and DaaS riders and manage all our stores centrally.”

Rohit Kathpalia

Associate Director IT – IT Strategy

KFC India Pvt Ltd

“Dista helped Ziqitza Healthcare Ltd improve fleet supervision and maintenance, significantly reducing fleet repair costs. We now seamlessly manage and track vehicle repair requests for maintenance, batteries, and tyres for over 3000 vehicles across India with Dista’s AI-powered fleet management solution.”

Himanshu Dhabalia

Head – IT

Ziqitza Healthcare Ltd

“By leveraging Dista Sales, we offered seamless doorstep services to our customers. The field sales management software auto-allocated leads to sales reps based on their real-time location. This helped them reach the customer location within the defined SLA and increased our customer onboarding.”

Shanmugam Manivannan

Vice President – Digital Banking

Equitas