Debt collection is a crucial pillar in lending that directly affects the lender’s overall revenue and profitability. Loan defaulters are a primary threat to Banks, NBFC, and Microfinance Institutions. It has become more critical for lending organizations to understand the repayment capacity of a borrower and map areas for high and low delinquencies. A robust delinquency management platform can help them streamline and automate the collection process.

Let’s learn about the challenges, benefits, and features of a debt collection management system.

Key Challenges for Debt Collections Management

1) Heavy Reliance on Manual Processes

Over-reliance on manual processes increases the possibility of errors, misplaced and lost documents, longer turnaround times (TATs), and more. Capturing case visit outcomes, handling cash, and generating receipts, are crucial debt collection tasks that can be cumbersome for a Field Collection Executive (FCE) if done manually. The lack of a quick way to access historical and other relevant case information can be a hassle.

2) Limited Visibility on FCEs

Lack of visibility on FCE is one of the key challenges of supervisors or managers. They need an effective way to allocate and distribute high-volume leads that can help them maximize collection. It is also not easy to track and monitor individual and team performance, and no way to get audit trails for FCEs.

3) Lack of AI-recommendation

Legacy systems offer little or no insights for business leaders that help in strategic decisions. Without a delinquency management platform, tracking vital data like real-time and overall collections, regions requiring management attention, etc., can be cumbersome. Moreover, there is no way to recommend nearby leads to FCEs based on their real-time location.

4) Reluctance to Update Legacy Systems

Organizations are reluctant to adopt new technologies and continue working on older and outdated systems. In several instances, decision-makers overestimate the cost and time involved while implementing new solutions. At the same time, they also need to pay more attention to the impact digital transformation will have on simplifying debt collection processes.

Features of Debt Collection Management Software

Let’s learn about some of the key features of debt collection management software.

1) Case Allocation

A robust debt collection platform, like Dista Collect, enables auto case allocation based on multiple business rules. The system allocates the right FCE for a case depending on factors like proximity, availability, priority, and more. It also enables managers to manually allocate cases to FCEs. This ensures lesser or no cases are left unaddressed and fastens the collection process.

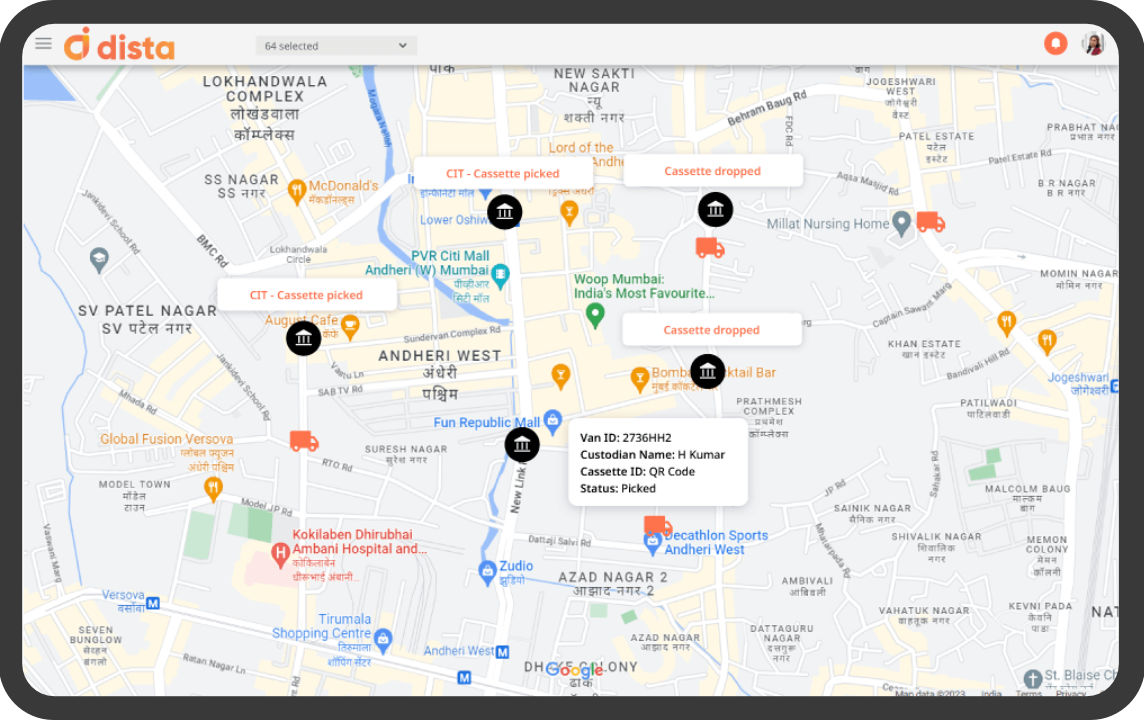

2) Performance Dashboard

Managers or supervisors can get their team’s overview with real-time status updates via multiple dashboards. A dedicated mobile app offers transparency and visibility in field operations, live location of FCEs, enables seamless communication with one-tap calling, and more. The system provides intelligent contextual nudges for supervisors to stay updated about the collection process. Debt collection management software also helps managers with skill recommendations and the real-time capacity of FCEs.

3) Intelligent Area Analysis

Dista Collect helps organizations identify and visualize areas that have customers with low/high spending potential, increased chances of delinquencies, and other insightful data. The system runs intelligent analysis by leveraging demographic and socio-economic data that is fed into our sales engine. It helps identify high-risk (negative) areas of a city that a bank has identified where residents would not qualify for credit approval.

4) Smart Recommendations

The software shares smart recommendations with all stakeholders to help them complete their tasks efficiently. FCEs receive intelligent contextual nudges about the next-best-action, like details about ad-hoc cases near their location, route optimization for faster TAT, and more. Similarly, nudges related to FCE’s location and tasks help them with better management. In case of business leaders, Dista Collect leverages AI/ML engines to assist with resource planning forecasts based on historical data.

Final Thoughts

A comprehensive debt collection management platform like Dista Collect leverages location intelligence and AI/ML-based engines to offer:

- Delinquency management and area definition and analysis for business leaders

- Real-time visibility and ETA on field collection executives for supervisors

- End-to-end case execution via an app that acts as a mobile office for FCEs

If not addressed in time, outstanding debts can substantially affect lending firms. Hence, it is important to leverage delinquency management software. Get in touch with us to know more.